Values and Valuation

Values and Valuation website. All Rights Reserved. Protected by copyright laws of the United States. The information provided is solely for informational purposes and does not constitute an offer to buy/sell any securities. All securities investments carry risk, including a risk of loss of principal. Investments may be volatile and can involve the loss of principal. Values and Valuation website is not a registered investment adviser and does not give individualized investor advice. The information resulting from the use of tools or other information on this internet site should not be construed, in any manner whatsoever as a recommendation to buy or sell an investment, nor as the receipt of, or a substitute for, personalized individualized advice and Values and Valuation website takes no responsibility for any investment decisions made as a result of reviewing the information contained herein at valuesandvaluation.com. Past performance is not a guarantee, nor is it always indicative of future results. Entities including but not limited to Values and Valuation website, its members and officers may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take opposing positions. This content of the website ValuesandValuation.com is property of Values and Valuation website. ©2013 Values and Valuation website.

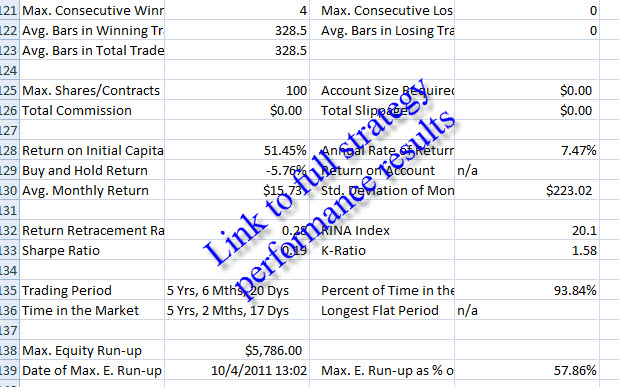

Six Factor Fixed Income Timing Model

This model incorporates six data streams relevant to fixed income investing. Given that it is a fixed income timing model, the main goals are capital preservation while collecting income. The six factor fixed income timing model returned 51.45% trading the ishares high-yield corporate bond ETF (HYG) compared to -5.76% for a buy and hold approach since 2007. I am currently working to find data that goes back further for more comprehensive testing.